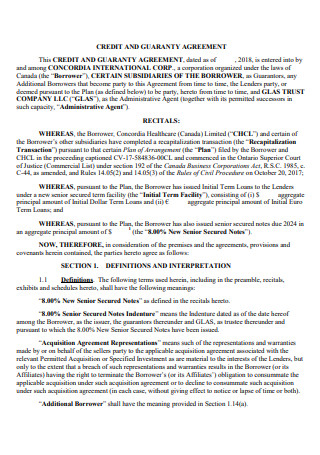

47+ Irs Installment Agreement While In Chapter 13

Actively participate in the trade or business while fulfilling your duties any fees you receive related to the operation of the trade or business must be reported as self-employment income on Schedule C of your Form 1040. Subpart 522 sets forth the text of all FAR provisions and clauses each in its.

The Mn Bankruptcy Blog Learn The Bankruptcy Process More William Kain

Direct evidence proves a fact without an inference or presumption and conclusively.

. Records or other documents. Fyp fypシ storytime bartender. To apply for an installment agreement online go to IRSgovOPA.

Must contain at least 4 different symbols. Include on line 2 the amount you received when you were age 59½ or older. AmendFix Return Form 2848.

Web If the taxpayer states he or she relied on written or oral advice from the IRS but does not qualify for relief in accordance with the criteria in IRM 20113341 Written Advice From the IRS or IRM 20113342 Oral Advice From the IRS refer to IRM 2011322 Ordinary Business Care and Prudence to determine if the taxpayer exercised. Deleted reference to outdated Fact Sheet 2013-9 Tips for Employers that Outsource Payroll Duties. Web Attach Copy B of Form 1098-C to Form 8453 US.

Web The information entered on CC ESIGN from Form SS-4 lines 16 and 17 is captured by ERAS and sent to both the Social Security Administration and the Census Bureau. Which provides that workers covered under a Section 218 Agreement are employees. 628 and announces that taxpayers may use either RESNET Publication No.

Return the joint-name. While at the game A buys hot dogs and drinks for A and B. This IRM discusses the estimated ES tax penalties outlined in the Internal Revenue Code IRC for both individual taxpayers IRC 6654 and corporate taxpayers IRC 6655.

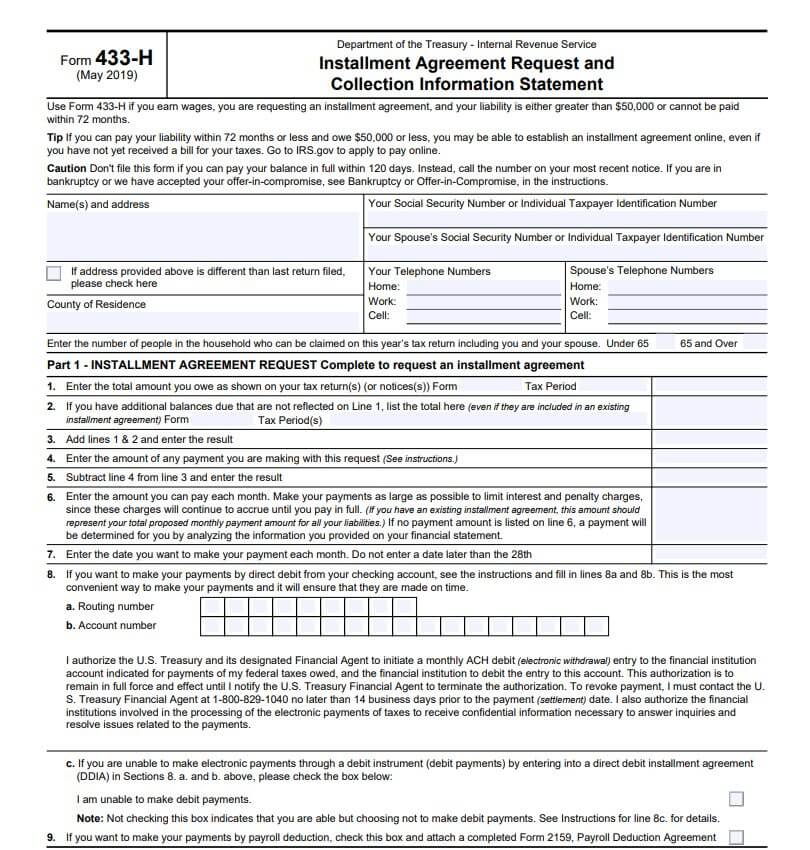

It is critical we capture the most accurate data possible to the extent it is provided by. Web Installment Agreement Request POPULAR FOR TAX PROS. Web Installment Agreement Request POPULAR FOR TAX PROS.

The IRS has jurisdiction over the. Or Include Copy B of Form 1098-C as a pdf attachment if your software program allows it. 5196134 LP61.

ASCII characters only characters found on a standard US keyboard. The baseball game is entertainment as defined in Regulations section 1274. Division O section 111 of PL.

Web chapter 99 cas row 2. Individual Income Tax Transmittal for an IRS e-file Return and mail the forms to the IRS. Web This announcement is a ministerial update to Notice 2006-27 2006-11 IRB.

For more information about. 6 to 30 characters long. Qualified distributions to reservists while serving on active duty for at least 180 days.

Extend the maximum age of eligible dependents from 12 to 13 for dependent care FSAs for the 2020 plan year and unused amounts from the 2020 plan year carried over into the 2021 plan year or for plans for which the end of the last regular. However other personnel from the IRS participated in the development of this guidance. Section 484121-1a of this chapter defines a producer generally as the person in whom is vested ownership of the coal under state law immediately after the coal is severed from the ground.

Web Modified AGI limit for certain married individuals increased. 05-001 or RESNET Publication No. See 50 Limit in chapter 2 for more information.

Web Wages earned while incarcerated are now reported on Schedule 1 line 8u. Web Retirement income accounts. Web Installment Agreement Request POPULAR FOR TAX PROS.

626 and Notice 2006-28 2006-11 IRB. AmendFix Return Form 2848. 116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after.

Web Comments and suggestions. AmendFix Return Form 2848. We welcome your comments about this publication and suggestions for future editions.

B Numbering 1 FAR provisions and clauses. A purchases tickets for A and B to attend the game. Web Section 4121 of chapter 32 of the Internal Revenue Code imposes a tax on the producers sale of such coal.

Web Installment Agreement Request POPULAR FOR TAX PROS. Web Installment Agreement Request POPULAR FOR TAX PROS. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Proof is the end result or effect of evidence while evidence is the medium or means by which a fact is proved or disproved. Youre under no obligation to play along TikToker and bartender Cayley Yanko imacayk recalls the time she accidentally spilled the beans on a customers affair and viewers didnt hold back on sharing their thoughts about exposing someones infidelity. While sorting mail look for live checks cash or other items of value such as credit or debit cards or gift cards.

DE has no income tax return filing requirement as a result of final regulations under section 6038A it will now be required to file a pro forma Form 1120 with Form 5472 attached by the due date including. AmendFix Return Form 2848. Web Because the IRS processes paper forms by machine optical character recognition equipment you cannot file Form 1096 or Copy A of Forms 1098 1099 3921 or 5498 that you print from the IRS website.

Web Installment Agreement Request POPULAR FOR TAX PROS. Distributions incorrectly indicated as early distributions by code 1 J or S in box 7 of Form 1099-R. For further information regarding this notice contact.

AmendFix Return Form 2848. AmendFix Return Form 2848. NW IR-6526 Washington DC 20224.

Web Installment Agreement Request POPULAR FOR TAX PROS. Provides an exclusion from gross income for COD income if the discharge occurs while the taxpayer is bankrupt or insolvent or if the indebtedness discharged is qualified farm indebtedness certain qualified real property. Dfars dfarspgi afars affars dars dlad nmcars sofars transfars row 3.

If you dont pay your tax when due you may have to pay a failure-to-pay penalty. Agar aidar car dear diar dolar. Web 5196132 LP 47 Decision Chart.

But see Online fillable forms later. See Tax Figured by IRS in chapter 13. Chief Counsel Employee Benefits Exempt Organizations and Employment Taxes.

AmendFix Return Form 2848. Modification as used in this subpart means a minor change in the details of a provision or clause that is specifically authorized by the FAR and does not alter the substance of the provision or clause see 52104. While a foreign-owned US.

See IRM 2171325 and IRM 2171326 for additional information on the use of this data. It is the authoritative source of information regarding servicewide policy and procedure with respect to these penalties. Web Qualified retirement plan distributions made due to an IRS levy.

If you are married and your spouse is covered by a retirement plan at work and you arent and you live with your spouse or file a joint return your deduction is phased out if your modified AGI is more than 204000 up from 198000 for 2021 but less than 214000 up from 208000 for 2021. A request for an installment agreement promise to pay in the future or states currently making payments. Web Installment Agreement Request POPULAR FOR TAX PROS.

You can also use. 06-001 to determine whether a dwelling unit qualifies for the new energy efficient home credit. Web Bartender says she accidentally revealed customers affair.

- including submitting a.

Irs Installment Agreement Guide On Irs Payment Plans Supermoney

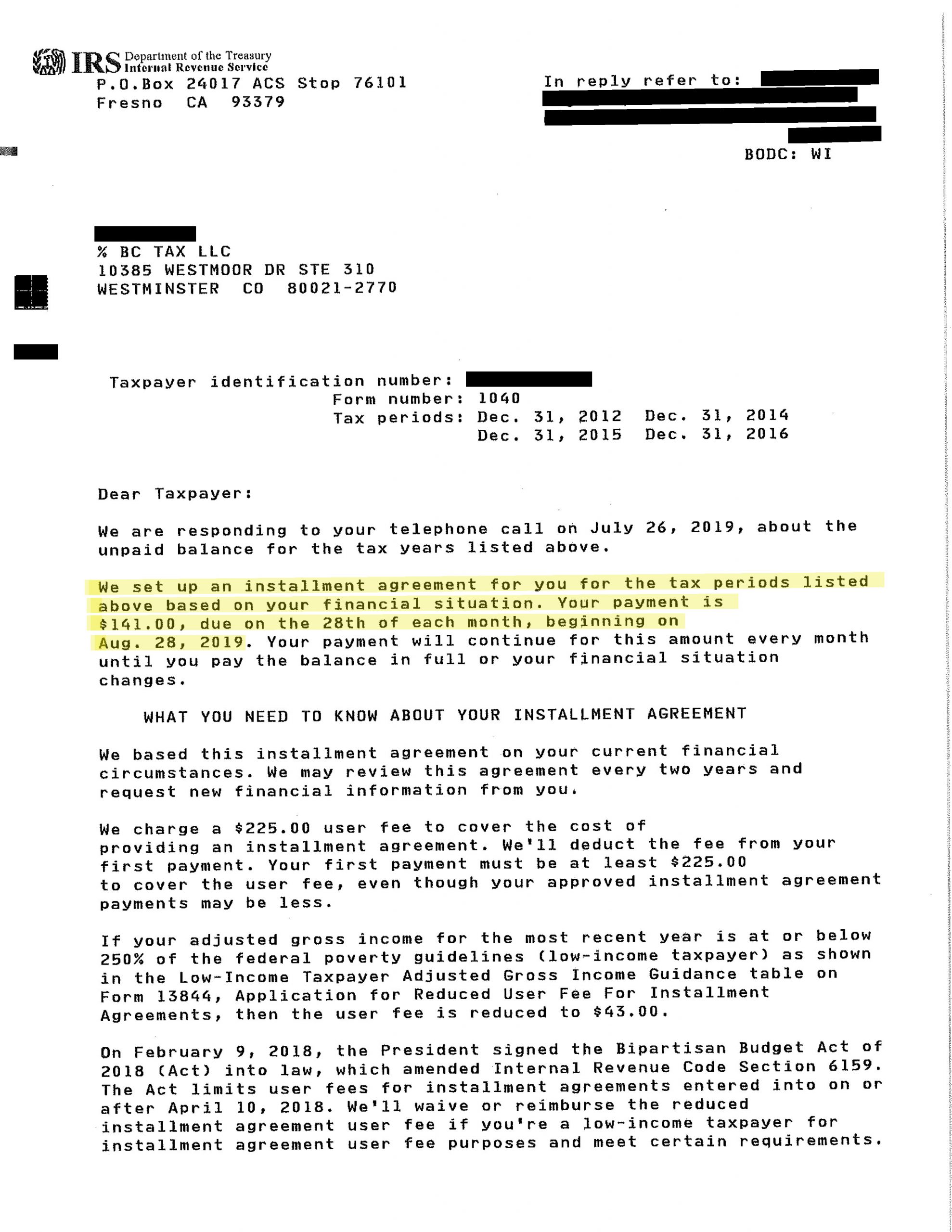

Taxpayer Owes The Irs Over 78 000 But Only Pays 141 A Month Bc Tax

Struggling In Irs Payment Plan Chapter 13 Bankruptcy May Be The Solution Anderson Tax Law

Syllabus Book

How Does Chapter 13 Bankruptcy Affect Tax Debt Steinberger Law

I Am In Chapter 13 And I Owe Taxes That I Cannot Pay In One Lump Sum Can I Go Into An Installment Agreement With The Irs Legal Answers Avvo

Free 10 Travel Services Agreement Samples In Ms Word Google Docs Pages Pdf

Applying For A Tax Payment Plan Don T Mess With Taxes

Irs Installment Agreement Vs Chapter 13 Bankruptcy Which Repayment Plan Saves You The Most Irs Tax Attorney Howard Levy

Chandler Az Defaulted Irs Payment Plan Tax Debt Advisors

Installment Agreement Tabb Financial Services

If I File Bankruptcy Do I Still Have To Pay An Irs Installment Agreement Youtube

Installment Agreements Offer An Alternative To Bankruptcy Steinberg Enterprises Llc

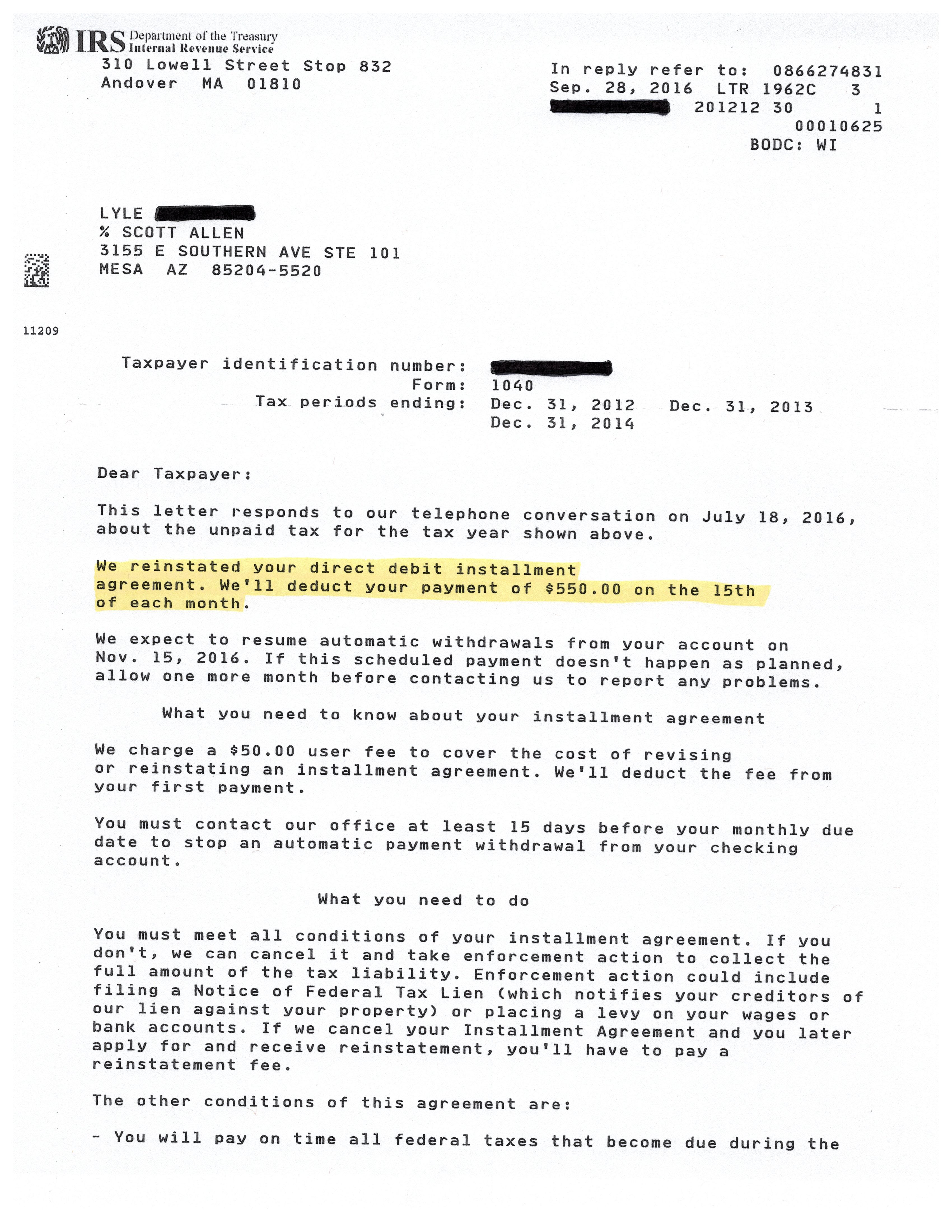

Mesa Irs Payment Plan May 2017 Tax Debt Advisors

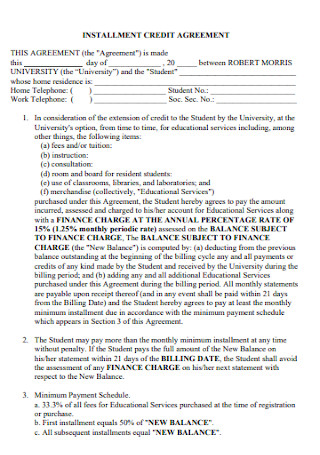

47 Sample Credit Agreements In Pdf Ms Word

47 Sample Credit Agreements In Pdf Ms Word

Pdf Monetnata Cirkulaciya V Gradisheto Kraj Odrci 310 G Pr Hr 610 G Sl Hr Coin Circulation In The Hill Top Settlement Near Odartsi 310 B C A D 610 Sergey Torbatov Academia Edu